Massachusetts Delays and Amends Paid Family and Medical Leave Law

Last week, the legislature and newly established Department of Family and Medical Leave made changes to the Paid Family and Medical Leave (“PFML”) law[1]. These changes delay many relevant dates under the PFML law, and also make some substantive changes.

The amendments include the following:

- The start date for required PFML contributions is now October 1, 2019. On that date, employers must begin withholding PFML contributions from employee qualifying earnings. Employers will be responsible for remitting employee and (if applicable) employer contributions for the October 1 to December 31 quarter through MassTaxConnect by January 31, 2020.

- Employers now have until September 30, 2019, to notify all covered individuals of their rights and obligations under PFML. The required notices are available on the Department of Family and Medical Leave website.

- Employers that offer paid leave benefits that are at least as generous as those required under the PFML law may apply to the Department for an exemption from making contributions. Employers will now have until December 20, 2019, to apply for an exemption that will excuse them from the obligation to remit contributions for the full period commencing with the October 1 start date.

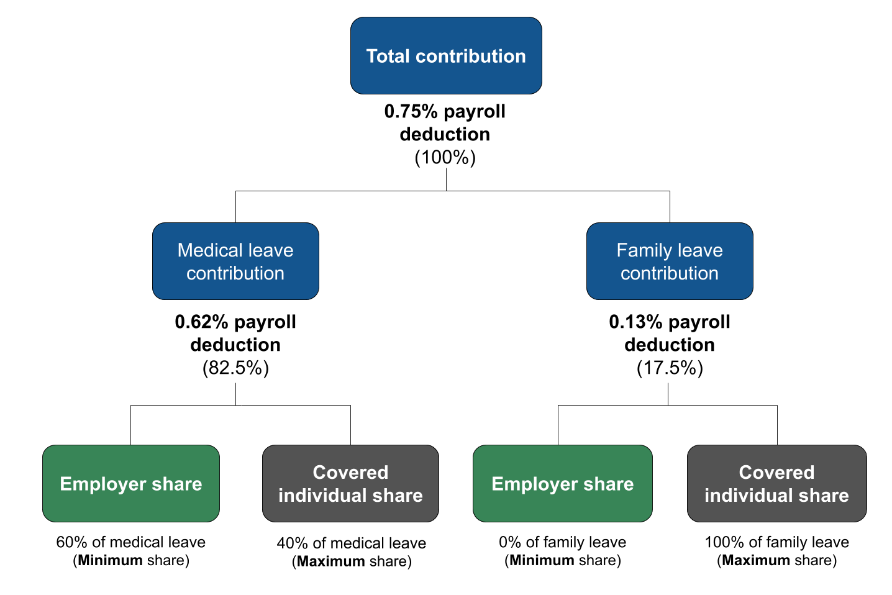

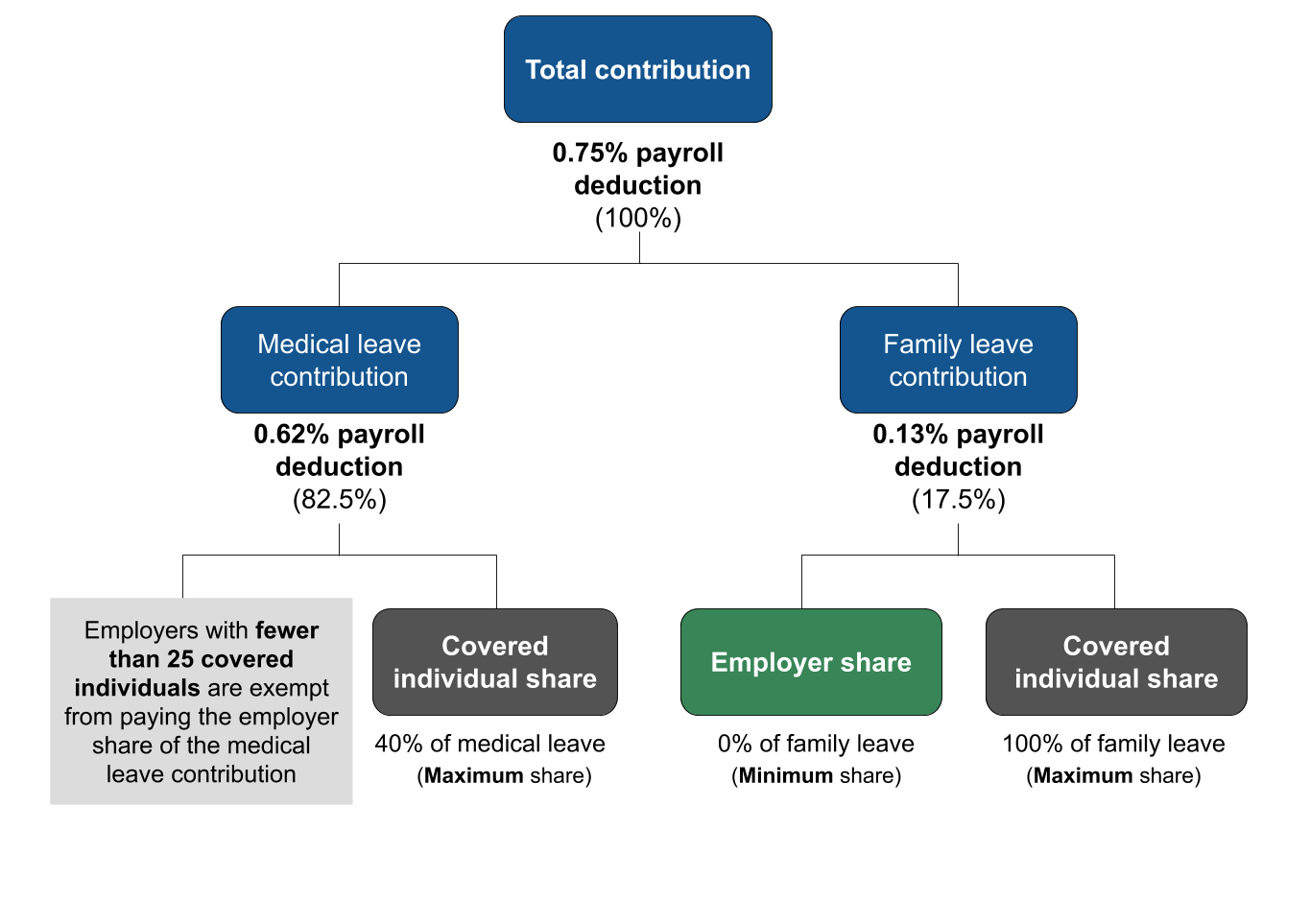

- The contribution rate has been raised from 0.63% to 0.75%. This now changes the contribution splits – of the 0.75%, 0.62% will be for the medical leave contribution, and 0.13% will be for the family leave contribution.

-

- For employers with 25 or more employees:

- The employer may deduct up to 40% of the 0.62% medical leave contribution from the employee, and must contribute at least 60% of the 0.62% medical leave contribution. The employer may deduct a lower percentage of the medical leave contribution from the employee, but is still responsible for remitting the 0.62% medical leave contribution.

- The employer may deduct the entire 0.13% family leave contribution from the employee, and is not required to contribute to the family leave contribution. The employer may deduct a lower percentage of the family leave contribution from the employee, but is still responsible for remitting the 0.13% family leave contribution.

- For employers with 25 or more employees:

-

- For employers with less than 25 employees:

- The employer may deduct up to 40% of the 0.62% medical leave contribution from the employee, and is not required to contribute to the medical leave contribution. The employer may deduct a lower percentage of the medical leave contribution from the employee, but is still responsible for remitting 40% of the 0.62% medical leave contribution.

- The employer may deduct the entire 0.13% family leave contribution from the employee, and is not required to contribute to the family leave contribution. The employer may deduct a lower percentage of the family leave contribution from the employee, but is still responsible for remitting the 0.13% family leave contribution.

- For employers with less than 25 employees:

The Department has created visual breakdowns of the new contributions rates:

Employers with 25 or more employees:

Employers with fewer than 25 employees:

If you have questions or concerns about the PFML law, please contact any of our attorneys.

This update is provided for informational purposes only and should not be considered legal advice.

[1] If any part of your workforce is unionized, you may have a bargaining obligation over the new PFML law. Please contact a VDH attorney if you have any unionized employees to discuss your potential bargaining obligation.